Maldives

Maldives became a full member of SASEC in May 2014, together with Sri Lanka, following several years as an active observer. Bangladesh, Bhutan, India, and Nepal formed the project-based partnership in 2001.

The National Development Plan envisions Maldives as an an equitable, prosperous, inclusive, and connected island nation. The plan seeks to explore blue economy concepts, develop global value chains, and advocate gender mainstreaming by maximizing opportunities from its growing digital connectivity, improved infrastructure, and unique environmental and cultural resources.

SASEC Projects in Maldives

ADB-financed project and technical assistance have supported SASEC activities in Maldives to help advance the country's engagement in regional cooperation activities, including under the South Asian Association for Regional Cooperation (SAARC) and the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) frameworks. Maldives has actively participated in SASEC from 2012 to 2014 as an observer, and then as a full member. An ADB-supported national single window project (worth $11.99 million) will help develop an automated system to improve ease of doing business, in line with SASEC operational priorities for trade facilitation. In 2022, APVAX supported Maldives's COVID-19 recovery through a $10.77 million project to help upgrade vaccine storage facilities and strengthen distribution and administration of vaccines.

Four technical assistance projects (worth $5.80 million) support Maldives in implementing its national single window environment for international trade and support preparation for energy and other development projects.

Trade Snapshot

Direction of Intraregional Trade

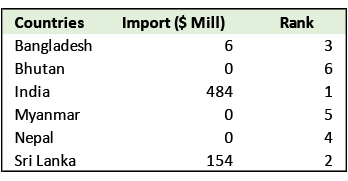

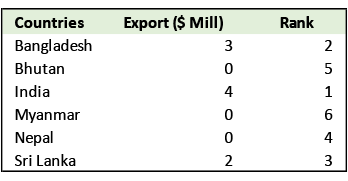

The value of Maldives' merchandise exports and imports trade with other SASEC countries, using International Monetary Fund data from 2025, is captured in the tables below.

Maldives' largest import source in the SASEC subregion is India, with imported goods valued at $484 million. Its 2nd largest import source is Sri Lanka, with imported goods valued at $154 million.

The country's top export destination in the subregion is India, with exports valued at $4 million. Its 2nd largest export market is Bangladesh with exports valued at $3 million and its 3rd largest export market is Sri Lanka, with exports valued at $2 million.

Maldives Trade - Import

Source: IMF Direction of Trade Statistics via ARIC Database, accessed June 2025

Source: IMF Direction of Trade Statistics via ARIC Database, accessed June 2025

Maldives Trade - Export

Source: IMF Direction of Trade Statistics via ARIC Database, accessed June 2025

Source: IMF Direction of Trade Statistics via ARIC Database, accessed June 2025

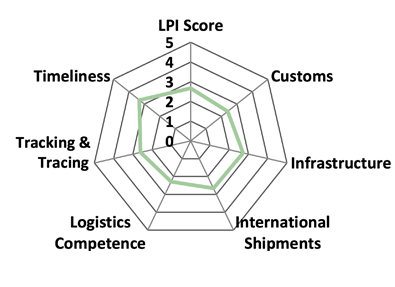

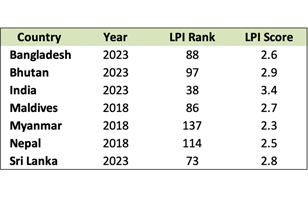

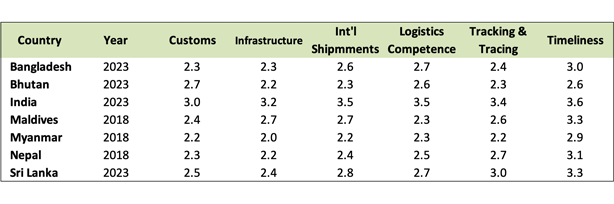

Logistics Performance Index (LPI)

Maldives' overall rank rose 14 notches to 86th place out of 168 economies in 2018, from a ranking of 104 in 2016. Its 2018 overall LPI score is 2.67, up by more than a point from its 2016 score of 2.51. Its 2018 score owes itself to improvements in customs, infrastructure, international shipments, tracking and tracing, and timeliness.

Source: World Bank LPI (accessed May 2023)

Note: The LPI overall score reflects perceptions of a country's logistics based on six core dimensions: (i) efficiency of customs clearance process, (ii) quality of trade- and transport-related infrastructure, (iii) ease of arranging competitively priced shipments, (iv) quality of logistics services, (v) ability to track and trace consignments, and (vi) frequency with which shipments reach the consignee within the scheduled time. The scores for the six areas are averaged across all respondents and aggregated to a single score using principal components analysis. A higher score indicates better performance.

Economic Outlook

Economic expansion in Maldives will moderate to 5.0% in fiscal year (FY) 2025 and 4.8% in FY2026 amid slowdowns in construction and the primary sector. Nevertheless, robust growth is expected in the tourism sector. Inflation is projected at 4.7% in FY2025 as price subsidies are removed, and ease to 2.2% in FY2026.

Source: Asian Development Outlook April 2025 (ADB)

Real GDP growth in Maldives in 2025 is forecast to accelerate to 6.7%, as the economy will get a boost due to the expected completion of a new airport terminal. Real GDP growth in 2026 is expected to moderate to 5.3%.

Source: South Asia Development Update April 2025 (WB)