What is SASEC

The South Asia Subregional Economic Cooperation (SASEC) program brings together Bangladesh, Bhutan, India, Maldives, Myanmar, Nepal, and Sri Lanka in a project-based partnership that aims to promote regional prosperity, improve economic opportunities, and build a better quality of life for the people of the subregion. SASEC countries share a common vision of boosting intraregional trade and cooperation in South Asia, while also developing connectivity and trade with Southeast Asia through Myanmar, to the People’s Republic of China, and the global market.

SASEC Vision

The SASEC Vision, and its supplement, SASEC Vision – Myanmar, articulate shared aspirations of SASEC countries, and set the path to achieve these through regional collaboration. These documents lay out a plan to transform the subregion by leveraging natural resources, promoting industry linkages for the development of regional value chains, and expanding the region’s trade and commerce through the development of subregional gateways and hubs.

SASEC Operational Plan

The SASEC Operational Plan presents the strategic objectives of the SASEC partnership, and the operational priorities of the four main SASEC sectors—transport, trade facilitation, energy, and economic corridor development. It is supported by a list of potential projects regularly updated by SASEC countries to be implemented during 2016-2025.

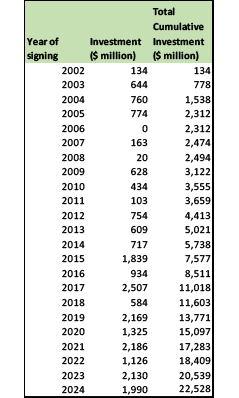

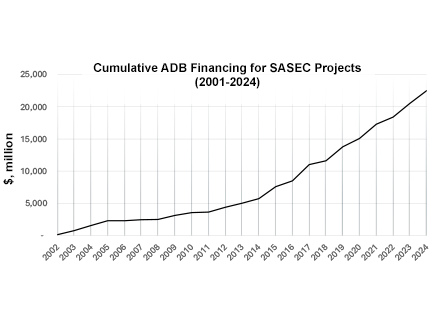

SASEC Projects and Technical Assistance

As of March 2025, SASEC countries have signed and implemented 91 ADB-financed investment projects worth around $22.53 billion in the transport, trade facilitation, energy, economic corridor, health, tourism, Information and communications technology sectors. The transport sector accounts for the majority of projects (50 projects worth around $14.61 billion), followed by energy (17 projects worth $3.59 billion), trade facilitation (9 projects worth $1.33 billion), and economic corridor development (7 projects worth around $2.32 billion). There are 4 regional cooperation projects under the health sector worth $584.93 million, along with 2 tourism projects worth $81.51 million and 2 ICT projects worth $20.80 million.

ADB-financed technical assistance has supported SASEC investment projects throughout the subregion, regional cooperation forums and knowledge-sharing initiatives, and pilot projects since 2001. A total of 159 national and regional technical assistance projects (cumulatively worth $229.81 million) have assisted countries in strategic planning, project preparation, and have supported SASEC forums, and capacity-building and knowledge-sharing events.

Trade Snapshot

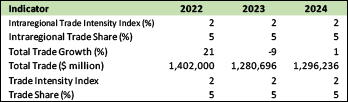

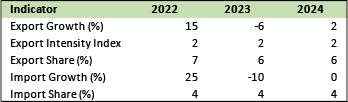

The tables below give a snapshot of trade, from 2022 to 2024, in the SASEC subregion, using International Monetary Fund (IMF) data on export, import, and international trade. Intraregional trade share among SASEC countries remained roughly constant at around 2% from 2022 to 2024.

Trade - Export/ Import

Source: IMF Direction of Trade Statistics via ARIC Database, as of April 2025

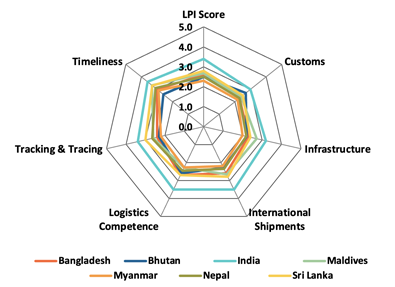

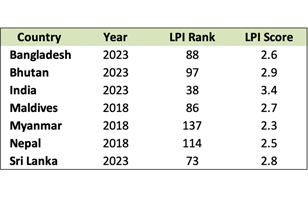

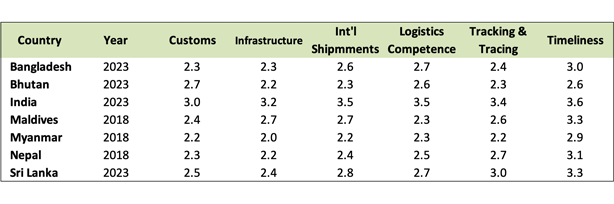

Logistics Performance Index (LPI)

The average 2023 LPI score for Bangladesh, Bhutan, India, and Sri Lanka is 2.9. The four countries garnered an average score of 2.6 for customs; 2.5 for infrastructure; 2.8 for international shipments; 2.9 for logistics competence; 2.8 for tracking and tracing; and 3.1 for timeliness. No new data is available for Maldives, Myanmar, and Nepal.

Source: World Bank LPI (accessed May 2023)

Note: The LPI overall score reflects perceptions of a country's logistics based on six core dimensions: (i) efficiency of customs clearance process, (ii) quality of trade- and transport-related infrastructure, (iii) ease of arranging competitively priced shipments, (iv) quality of logistics services, (v) ability to track and trace consignments, and (vi) frequency with which shipments reach the consignee within the scheduled time. The scores for the six areas are averaged across all respondents and aggregated to a single score using principal components analysis. A higher score indicates better performance.

Economic Outlook

Gross domestic product (GDP) in developing Asia and the Pacific is forecast at 5.1% in fiscal year (FY) 2025 and at 4.6% in FY2026. GDP in South Asia is forecast to grow by 6.5% in 2025 and 6.0% in 2026 driven by robust growth in manufacturing and services, particularly in India, where growth is forecast at 7.2% for fiscal year (FY) 2025-2026. For most of the South Asian subregion, growth forecasts have been retained from September 2025 edition of the Asian Development Outlook, where Bangladesh GDP was at 4.0% in FY2025 and 5.0% in FY2026, Bhutan at 8.1% in FY2025 and 6.0% in FY2026, Maldives at 5.0% in FY2025 and 4.9 in FY2026, Nepal at 4.6% in FY2025 and 3.0% in FY2026, and Sri Lanka at 3.9% in FY2025 and 3.3% in FY2026. In Southeast Asia, Myanmar’s GDP was previously projected at -3.0% in 2025 and 2.0% for FY2026. As of December 2025, inflation in South Asia is estimated at 3.3% for FY2025 and 4.7% for FY2026.

Source: Asian Development Outlook December 2025 (ADB)

Amid uncertainty in the global landscape, growth in South Asia is estimated to slow to 5.8% in FY2025 before picking up to 6.1% in FY2026. In Bangladesh, GDP growth will moderate to 3.3% in FY2024-2025 before rebounding to 4.9% in FY2025-2026. Growth in Bhutan will accelerate to 6.6% in FY2024-2025 and 7.6% in FY2025-2026. In India, growth is projected at 6.5% in FY2024-2025 and 6.3% in FY2025-2026; while in Maldives, growth will reach 5.7% in FY2025 and 5.3% in FY2026. Nepal's economy will grow to 4.5% in FY2024-2025 and 5.2% in FY2025-2026. In Sri Lanka, growth will moderate to 3.5% in FY2025 and 3.1% in FY2026. In Southeast Asia, the Myanmar Economic Monitor projects GDP to grow at 1.0% in Myanmar in FY2024-2025.

Source: South Asia Development Update April 2025 (WB)