Sri Lanka

Sri Lanka became a full member of SASEC in May 2014, together with Maldives, following several years as an active observer. Bangladesh, Bhutan, India, and Nepal formed the project-based partnership in 2001.

Sri Lanka is working toward achieving a people-oriented and open socioeconomic system that is focused on providing a decent quality of life for all. The report Sustainable Sri Lanka 2030 Vision and Strategic Path outlines Sri Lanka's aim to become a sustainable, upper middle income, Indian Ocean hub, with a prosperous, competitive, and advanced economy, an environment that is green and flourishing, and a society that is inclusive, harmonious, peaceful and just, through a balanced inclusive green growth (BIGG) approach. The report also highlights the country's aim to maximize its geostrategic potential to serve as an emerging transshipment and logistics hub as well as a commercial hub connecting different regions.

SASEC Projects in Sri Lanka

Since 2002, Sri Lanka has actively participated—as an observer, and then as a full member—in SASEC regional cooperation forums, knowledge-sharing activities, and capacity building. An ADB-supported project (worth $702.93 million) will help construct an elevated port access highway with related facilities, in line with SASEC operational priorities for transport. Six technical assistance projects (worth $6.88 million) support Sri Lanka’s energy and transport sectors.

Trade Snapshot

Direction of Intraregional Trade

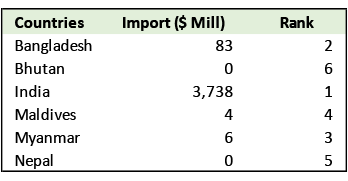

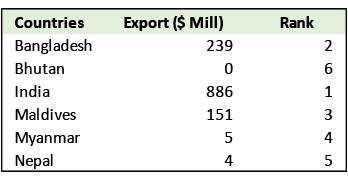

The value of Sri Lanka's merchandise exports and imports trade with other SASEC countries, using International Monetary Fund data from 2025, is captured in the tables below.

India is Sri Lanka's number 1 import source in the SASEC subregion, with imported goods valued at over $3.7 billion. Sri Lanka’s number 2 import source is Bangladesh, with imports valued at 83 million.

India ranks first as Sri Lanka's top export destination, with exported goods from Sri Lanka to India valued at $886 million. Bangladesh is its 2 top export market in the SASEC subregion, with exports valued at $239 million. Sri Lanka's 3rd largest export market is Maldives, with exports at $151 million.

Sri Lanka Trade - Import

Source: IMF Direction of Trade Statistics via ARIC Database, accessed June 2025

Source: IMF Direction of Trade Statistics via ARIC Database, accessed June 2025

Sri Lanka Trade - Export

Source: IMF Direction of Trade Statistics via ARIC Database, accessed June 2025

Source: IMF Direction of Trade Statistics via ARIC Database, accessed June 2025

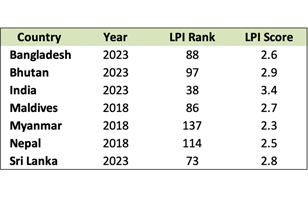

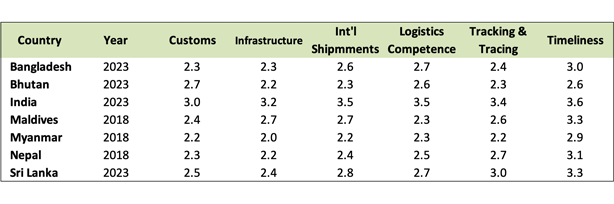

Logistics Performance Index (LPI)

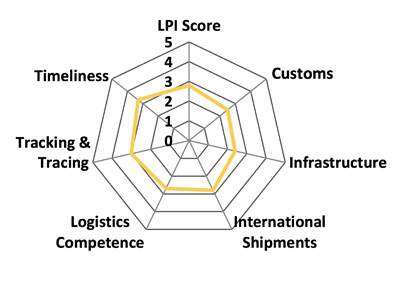

After garnering 2.6 in 2018, Sri Lanka posted an overall LPI score of 2.8 in 2023. This brings the country at rank 73 out of 139 economies for 2023, compared to 94 for 2018. Sri Lanka's best scores come from timeliness (3.3), tracking and tracing (3.0), and international shipments (2.8).

Source: World Bank LPI (accessed May 2023)

Note: The LPI overall score reflects perceptions of a country's logistics based on six core dimensions: (i) efficiency of customs clearance process, (ii) quality of trade- and transport-related infrastructure, (iii) ease of arranging competitively priced shipments, (iv) quality of logistics services, (v) ability to track and trace consignments, and (vi) frequency with which shipments reach the consignee within the scheduled time. The scores for the six areas are averaged across all respondents and aggregated to a single score using principal components analysis. A higher score indicates better performance.

Economic Outlook

On the heels of Sri Lanka's strong rebound in fiscal year (FY) 2024, GDP will moderate to 3.9% in FY2025 and continue to 3.4% in FY2026. Infrastructure investments and a recovery in garments manufacturing are forecast to spur growth. Inflation is projected to reach 3.1% in FY2025 and 4.5% in FY2026 as demand recovers.

Source: Asian Development Outlook April 2025 (ADB)

Sri Lanka's real GDP growth is projected at 3.5% in FY205 amid uncertainties in the global economy, structural impediments to growth, and lingering effects of economic crisis. In FY2026, growth in Sri Lanka is expected to moderate to 3.1%.

Source: South Asia Development Update April 2025 (WB)